PRESS RELEASE – Multiverse Computing, a leading startup in quantum computing for finance with offices in Toronto and Spain, today announced it has completed a proof of concept project with the Bank of Canada that used quantum computing to simulate the adoption of cryptocurrency as a method of payment by non-financial firms.

“We are proud to be a trusted partner of the first G7 central bank to explore modeling of complex networks and cryptocurrencies through the use of quantum computing,” said Sam Mugel, CTO at Multiverse Computing. “The results of the simulation are very intriguing, and insightful as stakeholders consider further research in the domain. Thanks to the algorithm we developed together with our partners at the Bank of Canada, we have been able to model a complex system reliably and accurately given the current state of quantum computing capabilities.”

Companies may adopt various forms of payments. So, it’s important to develop a deep understanding of interactions that can take place in payments networks.

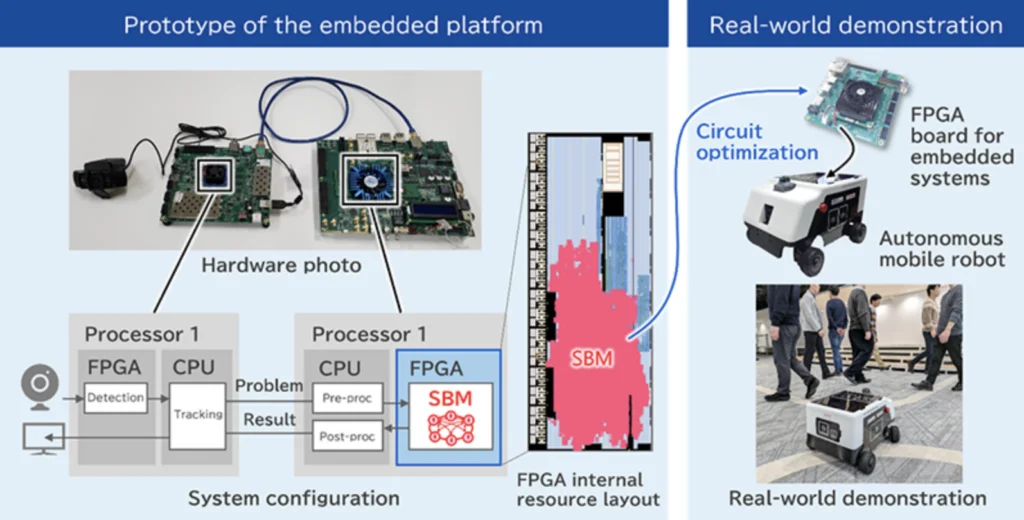

Multiverse Computing conducted its innovative work related to applying quantum computing for modeling complex economic interactions in a research project with the Bank of Canada. The project explored quantum computing technology as a way to simulate complex economic behaviour that is otherwise very difficult to simulate using traditional computational techniques.

By implementing this solution using a D-Wave Systems quantum annealer, the simulation was able to tackle financial networks as large as 8-10 players, with up to 2^90 possible network configurations. Note that classical computing approaches cannot solve large networks of practical relevance, as a 15-player network requires as many resources as there are atoms in the universe.

“We wanted to test the power of quantum computing on a research case that is hard to solve using classical computing techniques,” said Maryam Haghighi, Director, Data Science at the Bank of Canada. “This collaboration helped us learn more about how quantum computing can provide new insights into economic problems by carrying out complex simulations on quantum hardware.”

Motivated by the empirical observations about the cooperative nature of adoption of cryptocurrency payments, this theoretical study found that for some industries, these digital assets would share the payments market with traditional bank transfers and cash-like instruments. The market share for each would depend on how the financial institutions respond to the cryptocurrency adoptions, and on the economic costs associated with such trades.

The quantum simulations helped generate examples that illustrate how similar firms may end up adopting different levels of cryptocurrency use.

For more market insights, check out our latest quantum computing news here.