At the height of the pandemic in 2019, traders used a derivative — named a call option — to boost a relatively unappreciated and borderline tanking GameStop (GME) stock into one of the most highly valued company on NASDAQ. One trader used these options to turn a $50,000 investment into a $50 million position in a year.

The anecdote shows the power of derivatives. It doesn’t necessarily spotlight the risks, which are considerable, too. In fact, the infamous GameStop trade hints at an important use case for quantum computing to answer questions like: what is the price of these contracts and what is the best way to determine those prices?

A team of scientists from quantum computer startup Bleximo, which is focusing on building application-specific quantum hardware and appropriate software layers, have written a demonstration that outlines the steps needed to implement the quantum algorithm for Monte Carlo methods. The demonstration shows how to apply the quantum version of Monte Carlo to derivative pricing, covering the hardware requirements needed for running the algorithm.

According to the team, who posted about the demonstration on the company’s Medium blog, the call option is a contract that gives the owner the right to buy an asset at a fixed price — or strike price — before a set date, called the expiration date.

According to the team, who posted about the demonstration on the company’s Medium blog, the call option is a contract that gives the owner the right to buy an asset at a fixed price — or strike price — before a set date, called the expiration date.

The scientists point out that in 1973, Fisher Black, Myron Scholes, and Robert Merton created a method to price derivatives and became the bedrock for financial analysis of derivatives, which are used in trillion-dollar risk management techniques by numerous institutions. (The gross market value of all over-the-counter (OTC) derivatives in the second half of 2021 was about 12 trillion USD.)

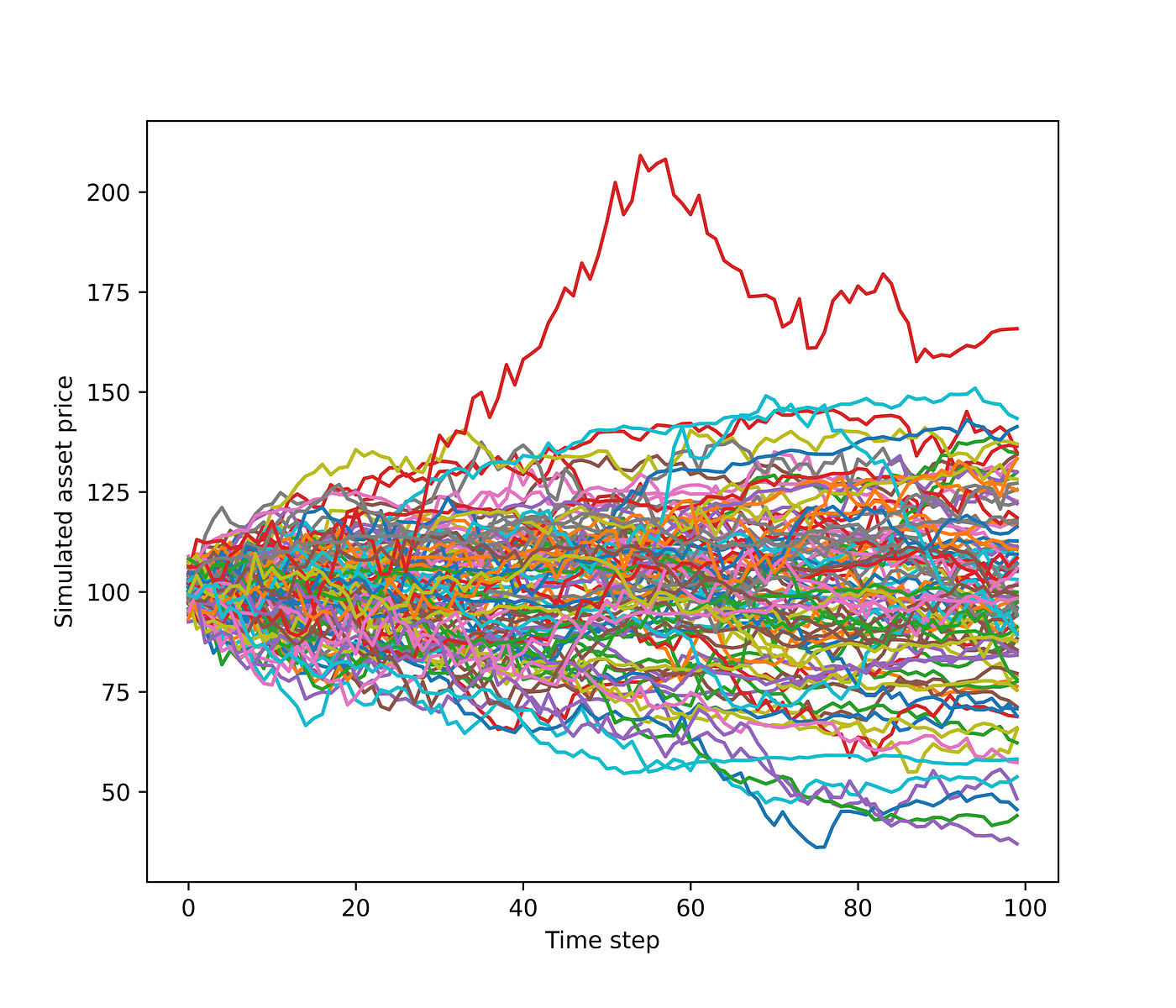

The researchers — Juan Adame and Fabio Sanches — write: “As it turns out, the price of these derivatives is often boiled down to computing an expected value. Often these expected values cannot be evaluated analytically, so one must resort to Monte Carlo simulations to estimate them. These simulations can quickly become computationally costly even for the world’s most powerful classical computers.”

Quantum computers could turn into tools to quickly and efficiently tackle Monte Carlo problems. In 2015, Ashley Montanaro published a quantum algorithm to accelerate Monte Carlo methods. However, quantum computers would need to be more mature than the current quantum devices. In other words, they would need a large number of qubits and low error rates to sufficiently accelerate Monte Carlo methods.

The researchers’ demonstration walks through the steps needed to implement the quantum algorithm for Monte Carlo methods on a simple European call option. The circuits are built using generic gates and techniques.

They write: “An algorithm such as this one is our starting point. We then focus on every step — the circuit encoding the algorithm, the compilation techniques, the gate set and processor layout, and the control systems — to build a high-performance integrated solution for these applications.”

You can download the notebook here.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.