Although it wasn’t a record-breaking first quarter in terms of financial gains, it was a historic first quarter for IonQ, the first publicly traded pure-play quantum computing company.

In an investor’s call and follow-up statement, IonQ (NYSE: IONQ) announced financial results and a business update for the third quarter ended September 30, 2021, its first since officially trading as a public company.

“IonQ delivered a number of significant milestones this quarter, delivering upon our technology roadmap and accelerating the commercialization of our quantum computers,” said Peter Chapman, President and CEO of IonQ.

The company reported revenue of $223,000 for a total revenue of $451,000 year to date. Company officials also reported a net loss of $14.8 million and adjusted EBITDA was a loss of $7.9 million. The company ended the period with cash and cash equivalents at $587 million.

The company also reported it has total contract value — TCV — bookings of $15.1 million year to date and increased guidance for 2021 TCV bookings from $15.0 million to $15.8 million. This is a forward looking metric and accounts for the signing of contracts into the future which may take a number of years to be executed and thus recognized as revenue.

IonQ officials also mentioned that IonQ its hardware is available through every major cloud provider in the United States, including Amazon Web Services, Microsoft Azure, and Google Cloud. Quantum Computing-as-a-Service, or cloud-based quantum computing, is one way to deliver access to quantum computers to the public.

Overall, the company is in solid financial shape to play what is most likely the long game in developing a practical quantum computer.

“The completion of our business combination with dMY Technology Group III gave us the capital to fuel additional momentum in our system development and commercialization efforts,” said Thomas Kramer, CFO of IonQ. “As part of our business combination, we are fortunate to now call Hyundai Motor Company and Kia Corporation, Silver Lake, MSD Partners, L.P., Breakthrough Energy Ventures, NEA, GV and Fidelity Management & Research Company LLC investors in IonQ.”

He added, “We believe our strong balance sheet with cash and cash equivalents of $587 million on September 30, 2021 will allow us to accelerate scaling of all business functions and continue attracting the industry’s best and brightest. We are well-capitalized and, we believe, well-positioned to benefit from Capitol Hill’s interest in quantum as shown by the infrastructure bill.”

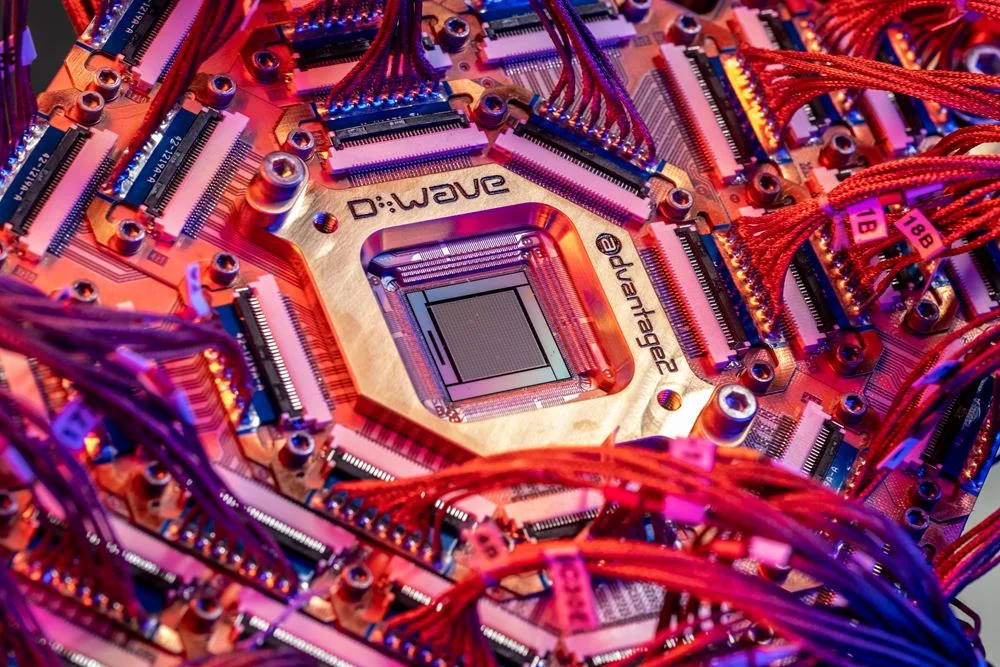

IonQ announced a new chip for the Company’s quantum processing unit, or QPU, that is aimed at stably increasing the number of qubits in its system., which could allow it to scale to hundreds of qubits on a single chip. The number of qubits is currently set at about a few dozen. The company also mentioned that IonQ and The University of Maryland researchers published results in Nature that documented cutting-edge error correction technology.

“We look forward to 2022 with confidence as we continue to build out IonQ’s ecosystem, demonstrate our superior scalability and efficiency, and solve useful problems for our worldwide customer base,” said Chapman.

According to the Quantum Insider, IonQ uses a trapped ion approach to quantum computing. Quantum computers require a precise and stable environment to manipulate qubits, which are the quantum version of computational “bits,” because they are vulnerable to slight environmental changes, such as heat and cosmic rays. In the trapped ion modality, ions — charged atomic particles — are isolated by suspending them in free space using electromagnetic fields.

Other quantum computing companies based on trapped ion include Honeywell Quantum Solutions and Alpine Quantum Computing. There are about six companies that use this modality in the space today, according to TQI.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.