Masses of Info

It’s a harsh reality that any investment or security that you have is subject to systematic risk, that’s just the nature of the financial world, with mispricing — causing a divergence between the market price of a security and the fundamental value of that security — a guilty party quite often. This is brought about by the world we now live in, information-heavy, with masses of unstructured data sets and with an infinite number of possible outcomes.

Luckily, there are now methods in place that can combat some of these difficulties and, with any luck, bring the investor a healthy return on their investment.

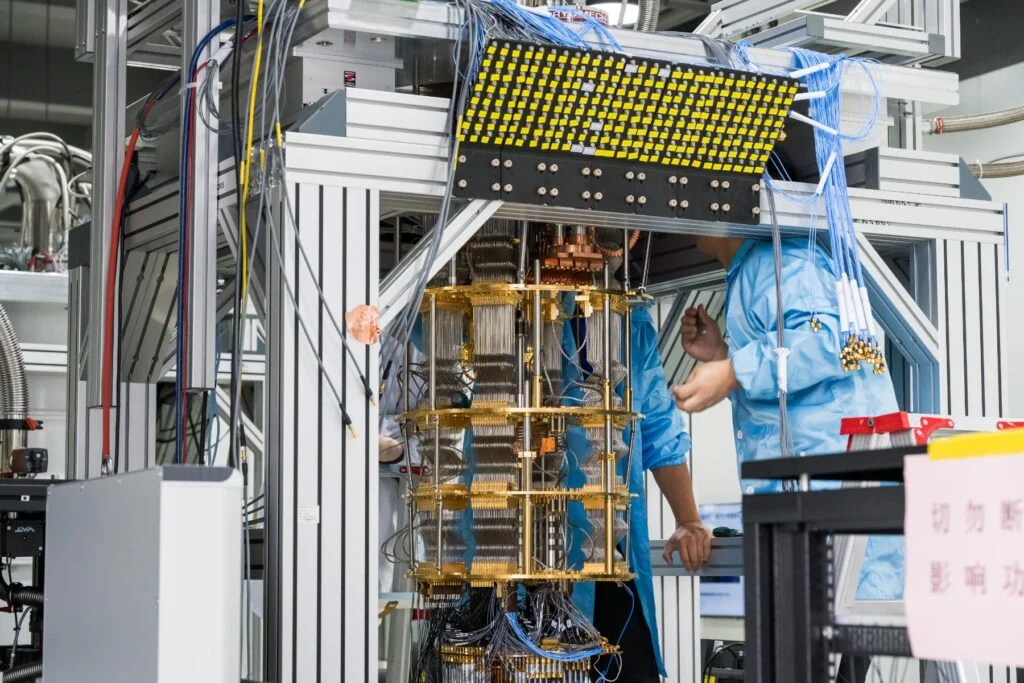

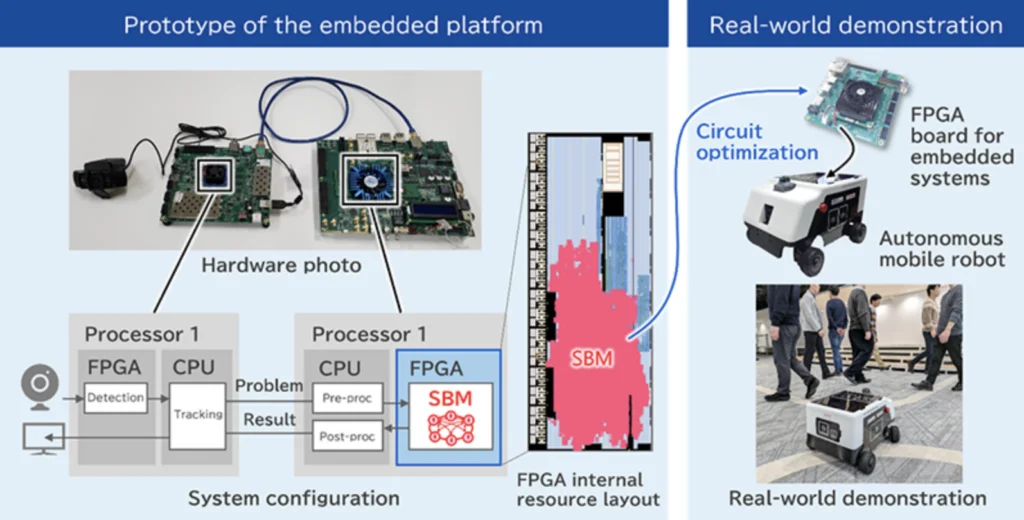

And it comes in the form of Al-driven, quantum-inspired solutions fuelled by state-of-the-art processors that are able to leverage the unique attributes of quantum physics to solve some of the most, up to now, unsolvable problems, with a handful of startups at the forefront of it.

These include Adaptive Finance Technologies, QuantFi and Zapata Computing which, to a greater or lesser degree, have their own unique approach to investment strategies in the global markets in securities pricing, portfolio optimization, equities, derivatives and the like.

We’ll look now, just at a handful of these whose data readers will be able to find on TQD’s very own data platform, The Quantum Insider (TQI), starting off with the three already mentioned before moving on:

1. Adaptive Finance Technologies

A Toronto-based startup specializing in quantum-enabled, AI-driven investment management solutions, Adaptive Finance Technologies is developing hybrid models and investment strategies for global markets in equities, derivatives, as well as other traditional and emerging asset classes.

It was founded in 2017 by Roman Lutsiv, Vlad Anissimov and Edward Tang.

Visit company’s profile page.

2. QuantFi

Founded by Paul Hiriart and Kevin Callaghan in 2019, QuantFi is a French research startup that specializes in creating quantum computer algorithms for the financial services industry achieved through engagement in fundamental and applied research in collaboration with leading universities and public laboratories.

In the long term, QuantFi wants to utilize quantum computing technology to perform financial portfolio management.

Visit company’s profile page.

3. Zapata Computing

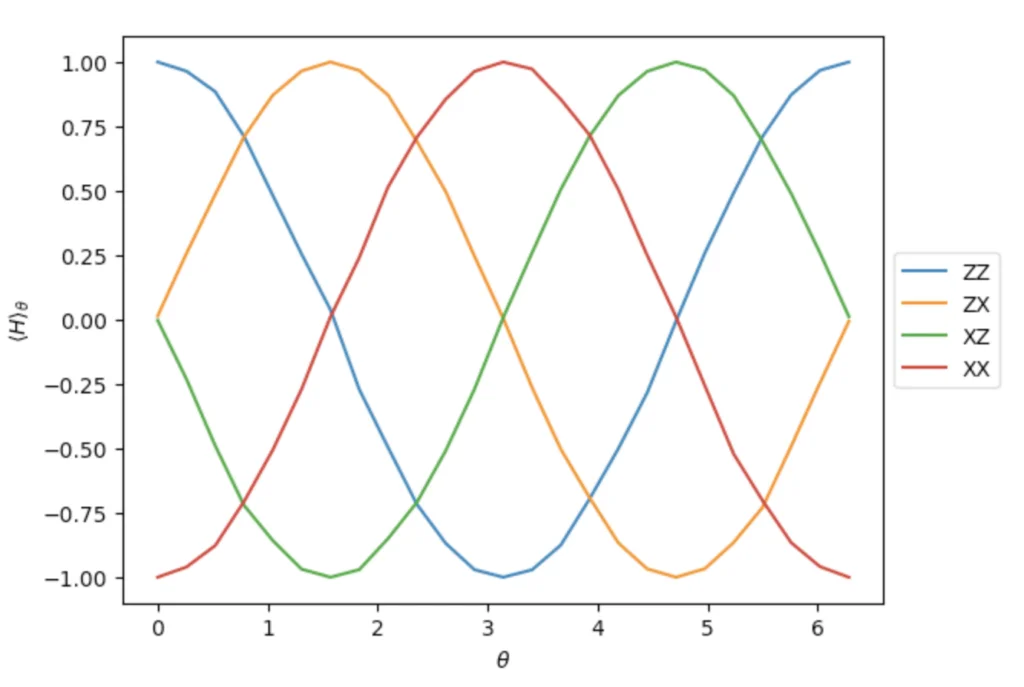

Boston-based Zapata Computing was founded in 2017 by Christopher Savoie, Alan Aspuru-Guzik, Yudong Cao, and Jhonathan Romero Fontalvo and is developing solutions for a wide range of industries including chemistry, logistics, finance, oil and gas, aviation, pharmaceuticals, and materials. Its platform, Orquestra(R), combines a powerful software platform and quantum algorithm libraries to deliver real-world advances in computational power for applications — particularly in chemistry, machine learning, and optimization. Orquestra enables users to compose quantum workflows and orchestrate their execution across classical and quantum technologies.

In finance, however, Zapata offers solutions in optimization by sampling from risk-neutral probability measures for asset pricing, portfolio optimization and asset allocation while optimizing ATM cash replenishment for maximal efficiency.

Its Machine Learning (ML) brings improved graph clustering analysis for anomaly and fraud detection, a feature selection for predicting financial data, time series analysis of financial data using quantum Boltzmann machines, dimensionality reduction for financial data using quantum-classical hybrid optimization, and financial data augmentation with generative ML to improve financial simulation by increasing the size of the dataset.

Improvements in simulation and modelling come about with the quantum-assisted Monte Carlo for derivative pricing, credit valuation adjustment and accelerated sampling from stochastic processes for risk analysis.

Visit company’s profile page.

4. CogniFrame

Another Toronto-based quantum startup, CogniFrame uses Near and Quantum Hybrid solutions along with ML to solve NP-Hard, complex optimization, ML, and simulation problems.

Founded in 2016 by Visweswaran Vish R, CogniFrame’s ML techniques (GAN, qGAN, Neural networks, Decision Trees, etc.), risk modelling and proprietary problem reformulation and pre-processing to deliver solutions for financial institutions to improve their outcomes combination of classical and quantum optimization, as well as simulation algorithms and processes, and are out to help institutions improve their outcomes.

Visit company’s profile page.

5. JoS Quantum

JoS Quantum is a German quantum startup laser-focused on finance, insurance and energy. Its quSAA project, funded by the Federal Ministry of Education and Research (BMBF), has been designed for strategic asset allocation, investigates the application of quantum algorithms to achieve lower fluctuations of investment portfolios to contribute to the stabilization of companies and thus of the financial system.

Based in Frankfurt, Markus Braun founded the startup in 2018.

Visit company’s profile page.

As the wider public become more aware of quantum technologies through greater press coverage, academics find better solutions from their research efforts and key business people see the advantages they can gain using quantum-inspired algorithms and optimization programs for their commercial exploits, the startup ecosystem will naturally see a growth spurt, not just for the financial sector, but for other industries, too.

The Quantum Insider (TQI)

This article was inspired by data from The Quantum Insider (TQI), TQD’s very own data platform. Here you can find deep and insightful information on all aspects of the QIS industry.

TQI is an invaluable resource for journalists, researchers, investors, companies, and government agencies looking to extend their knowledge of the growing quantum tech ecosystem!

Deep Tech Insider (DTI)

Interested in other niches of deep tech? Good, TQD team has that covered, too: Check out the Deep Tech Insider, the best place for news on all that is happening in the world of deep tech.

For more market insights, check out our latest quantum computing news here.