A flurry of reports suggest that U.S. venture capital giant Bessemer Venture Partners will lead an investment group in a $100-million (US) funding of Canadian startup Xanadu Quantum Technologies Inc., according to the Globe and Mail.

The Globe and Mail’s sources also said that the deal would value Xanadu, which is headquartered in Toronto, at $400-million (US) post-transaction.

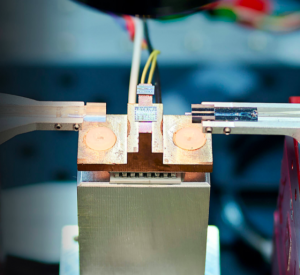

According to The Quantum Insider, Xanadu is a full-stack developer of quantum photonic processors and an open-source quantum software platform called PennyLane. Currently, Xanadu offers several clients cloud-based access to its devices.

Using photons as qubits has many advantages, however, a key challenge is that entangling them (a key requirement to leverage the power of computation), is inherently probabilistic and hard to achieve. Xanadu’s approach is based on using what they describe as “squeezed light”. The generation of a squeezed state is fundamentally deterministic; rather than working with single photons, Xanadu works with modes of light.

The company’s previously disclosed funding was ~$32m. Investors include Creative Destruction Lab, DARPA, Georgian Partners, Golden Ventures, OMERS Ventures, Radical Ventures, Real Ventures, Silicon Valley Bank, Sustainable Development Technology Canada and Tim Draper.

The company’s previously disclosed funding was ~$32m. Investors include Creative Destruction Lab, DARPA, Georgian Partners, Golden Ventures, OMERS Ventures, Radical Ventures, Real Ventures, Silicon Valley Bank, Sustainable Development Technology Canada and Tim Draper.

This would be Bessemer Venture Partners’ second investment in quantum tech. It is also an investor in Rigetti. Bessemer is a leading venture capital firm with past bets made in an LinkedIn, Yelp, Skype, Pinterest, Clio and Ada Support.

The latest funding round in Xanadu is just a recent example of brisk funding activity in quantum during just the first few months of 2021. Most recently, Maryland-based IonQ entered into a SPAC — Special Purpose Acquisition Company — that gave the quantum startup a pro forma implied market capitalization of the combined company is approximately $2 billion (Implied Enterprise Valuation of $1.4 billion).

Analysis

- This is the third largest ever quantum computing hardware funding rounds, with only IonQ and PsiQuantum’s raises being larger.

- The $400m valuation sounds relatively low – Cambridge Quantum Computing raised $45m at a reported $450m valuation as a comparison. There are a number of factors (and guesswork) that goes into such valuations so readers should not read too much into this.

- This is Bessemer’s second foray into investing in quantum computing. It’s interesting that they now hold stakes in both Rigetti (superconducting) and Xanadu (photonics). Is the investment firm hedging its bets or doubling down on quantum computing as a whole?

- Total disclosed private investment in 2021 to date (i.e. excluding government initiatives) now sits at >$800m according to The Quantum Insider.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.