When we think about quantum computing, we tend to think of companies and startups that are either purely quantum-based, or at least are being nurtured by technology companies, like Google and Microsoft. Quantum computers, after all, require lots of sophisticated equipment, lots of specific expertise and lots of money to build, maintain and use. But that doesn’t mean that publicly traded non-tech companies aren’t currently positioning themselves to take advantage of quantum computing. In fact, quantum advantage is a term that refers to the ability for quantum computing to offer performance advantages over classical computing.

If that day does come, then the following non-quantum tech companies, which are spread out across several industries, are already experimenting with quantum computation into certain business processes. This early adoption may confer an early mover advantage over these companies.

Because quantum computing is expected to be better suited for certain processes (for example, logistics and optimization), a few industries, such as transportation and engineering, are already first in line for possible quantum advantage.

We’ll start with the automobile industry where several major players are already queuing up for quantum advantage.

AUTOMOTIVE

Volkswagen

The people’s car company — Volkswagen — sees quantum computing as a technology that could give them a competitive nudge in several areas. One place the company’s leaders project quantum computing will help them is in traffic control. Working with D-Wave, VW is investigating how quantum algorithms could help drivers avoid traffic jams. This work might also be a precursor to autonomous driving, another area where quantum computers are expected to impact. The company writes about the study on its online news site.

VOLKSWAGEN AG/ADR

OTCMKTS: VWAGY

(Fun fact: The Passat/Santana was once marketed as the Volkswagen Quantum in North America.)

Daimler (Mercedes-Benz)

According to the company website: “Daimler embarked on its QC partnership with Google in early 2018, and later that year began fundamental research projects in the fields of materials science and quantum chemical simulation.”

As this research collaboration has continued, the company said, Daimler has been able to meet with and discuss research with the Google scientists and hardware team members. This type of interaction with crack quantum scientists may be just as important as access to the technology is. The Daimler group is looking beyond quantum advantage — and right at quantum supremacy and beyond.

Tyler Takeshita, the Global QC Technical Lead at Daimler, said “We are excited to work with Google in making some of the first real experimental contributions of the post-supremacy era.

DAIMLER AG/ADR

OTCMKTS: DMLRY

“While we’re still in the early stages of quantum computing development, encouraging progress has been made that can help us take what we’ve learned in the field and start to apply it to problems we want to solve today, while scaling to more complex problems tomorrow.”

Ford

According to Ford, quantum computing is more than just a faster horse, it’s a pivotal piece of their technological strategy. Ford has partnered with Microsoft to use “quantum-inspired” technology to simulate thousands of vehicles, in order to understand the impact on congestion.

The company reports: “While we’re still in the early stages of quantum computing development, encouraging progress has been made that can help us take what we’ve learned in the field and start to apply it to problems we want to solve today, while scaling to more complex problems tomorrow.”

Ford’s quantum expert Joydip Ghosh said, “We see quantum computing as a strategic priority.”

NYSE: F

Tesla?

The one company I couldn’t connect to quantum, but (at least I) expected to, is Tesla. The electric car manufacturer has revolutionized the automobile industry, from production to battery design to autonomous driving capabilities. Yet, there’s no sign — based on my research, at least — that the company is delving into quantum, even though many of the processes Tesla is considered so innovative in — autonomous driving, materials design, etc. — are natural fits for quantum problem-solving. It’s worth keeping an eye on — if anyone has Elon Musk’s number, maybe you could ask him?

NASDAQ: TSLA

AEROSPACE

Boeing

Quantum is finding a home in many transportation-oriented business, so we’ll stay in transportation area, but take to the air to find public companies that are positioning themselves to seize quantum advantage.

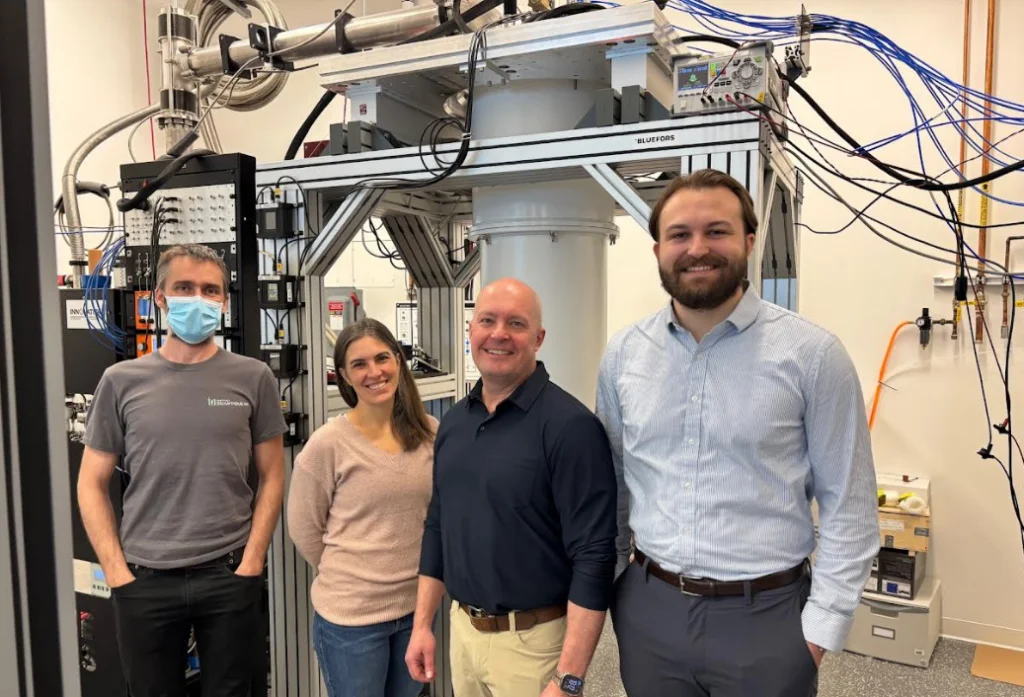

Boeing, one of the, if not THE largest aerospace companies created a Disruptive Computing and Networks (DC&N) organization for advanced computing and communications — and that definitely includes quantum.

DC&N, along with Boeing HorizonX, the company’s innovation team, could look to leverage quantum advantage in a number of devices and processes, including materials, secure communications, and advanced sensing.

NYSE: BA

Airbus

Boeing’s erstwhile competitor Airbus announced that it refuses to be left in the dust — or the clouds, as it were — of using quantum computers to gain business advantage. In 2019, the aerospace company announced a competition seeking ways quantum computing could help the company. The company specifically is looking for ways that quantum computation can help solve tricky flight physics problems, which affect every aspect of an aircraft’s lifespan, from design to operation. Due to the COVID pandemic, the results of the competition have been placed on hold for the time being.

OTCMKTS: EADSY

FINANCE

Financial companies, in a weird way, are similar to transportation companies. Transportation companies want to move people and things as far as they can, as fast as they can, and as inexpensively as they can. Financial companies know that moving information as fast, as easy, and as cheaply as possible will unleash competitive advantages. That’s why they’re another industry trying to seize quantum advantage.

“The company wants to use QC for two reasons: first, to help protect accounts and, second, to make better investment choices.”

JPMorgan Chase

Just this summer, we discussed how JPMorgan Chase is using Honeywell’s quantum computer for a series of experiments. The company wants to use QC for two reasons: first, to help protect accounts and, second, to make better investment choices.

The authors posted their findings on arXiv, an open-source site for researchers. Papers on arXiv typically are awaiting peer-review.

NYSE: JPM

Goldman Sachs

Goldman Sachs Group Inc. is interested in leveraging quantum-computing technology to explore whether it could help speed up financial calculations and artificial-intelligence-based decision making, according to the Wall Street Journal. The bank is working with QC Ware Corp., a Palo Alto, Calif.-based startup, to understand the limitations of current quantum-computing technology.

NYSE: GS

Wells Fargo

The logo of Wells Fargo signals the company knows something about the importance of speed and finance. According to the American Banker, the bank recently signed an agreement with IBM and MIT to collaborate on advanced technology, including what might be the ultimate speed-up for financial companies — quantum computing. Van Beurden says the goal is to test and learn about the technology in order to determine its best use cases and potential impact on financial services.

Wells Fargo’s technology chief said that the foray into quantum at this point is to test and experiment.

“There are three camps in the industry,” said Saul Van Beurden, a senior executive vice president and head of technology. “There’s the camp that says quantum will never come to production. There is the camp of people who believe it will take a long time before it will get in production, a long time defined as 10 or 15 years, maybe longer. And there is a camp that says, well, things might go faster. You’d better test and learn and be on it, because if this wave starts to take off, it might have game-changing impact for the industry. We are in the third camp. That’s why we signed up. We don’t want to be the bank that has regrets in a few years.”

NYSE: WFC

PHARMACEUTICALS

In addition to just the sheer computational manhandling of proposed quantum computers, the technology’s unique ability to simulate complex quantum- and molecular-size models makes it especially attractive to pharmaceutical companies.

Merck

Merck has a fever for quantum technology. It is both an investor and an adopter of quantum devices. The pharmaceutical giant has recently announced a partnership with HQS Quantum Simulations. The effort will focus on applying and commercializing software for quantum chemical applications on quantum computers. The company’s venture arm also invested in quantum computing startup Seeqc.

NYSE: MRK

Disclosure: I have positions in TSLA and GS.

Remember this article is not to be seen as recommendations to buy any of these stocks. The stock market is hard to predict, let alone predicting how the quantum market will change over the next few years. Do your due diligence to find stocks that fit your own goals and risk profile.

Disclosure: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by TQD or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.