There is a tight connection between finance and computing, according to researchers, who add that this connection will not cease if — or when — quantum computing becomes more mainstream. In fact, it could alter financial technology in many ways.

This connection, however, became more obvious with the start of derivative trading and after the finacial crisis of 2007, according to Sergio Focardi, professor and researcher at the Finance Group, ESILV EMLV, of the Pole Universitaire De Vinci, Paris and Davide Mazza, research assistant and teacher at MIP-Politecnico di Milano School of Management, Italy.

The researchers, who wrote a piece for the Conversation, said that derivatives pricing started with the celebrated Black and Scholes equation and formulas in 1974, followed by a wealth of mathematical methods to compute the prices of derivatives. These computations required supercomputers, giving big firms a major competitive advantage—before the 2007 crisis, the trading volume was close to $1 trillion a day.

“The prevailing opinion was that derivatives had enabled us to complete financial markets so that any stream of cash flows could be engineered,” the researchers write. “This belief was shattered by the 2007 financial crisis, which showed that hedging can be perfect only as long as counterparties stay solvent. With the failure of Lehman Brothers, the world of finance became painfully understood that there is risk in derivatives and that free markets are not self-regulating.”

Despite crises and flash crashes, there’s no reason to expect that relationship between finance and computation will stop at the quantum era. In fact, experts suggest that financial engineers will find quantum computation irresistible for use in the industry. Quantum computers, which use qubits that are a superposition of binary states that can theoretically process a large amount of information thousands of times faster than classical computers, may change financial technology — or fintech — forever.

1. Post-Quantum Cryptography

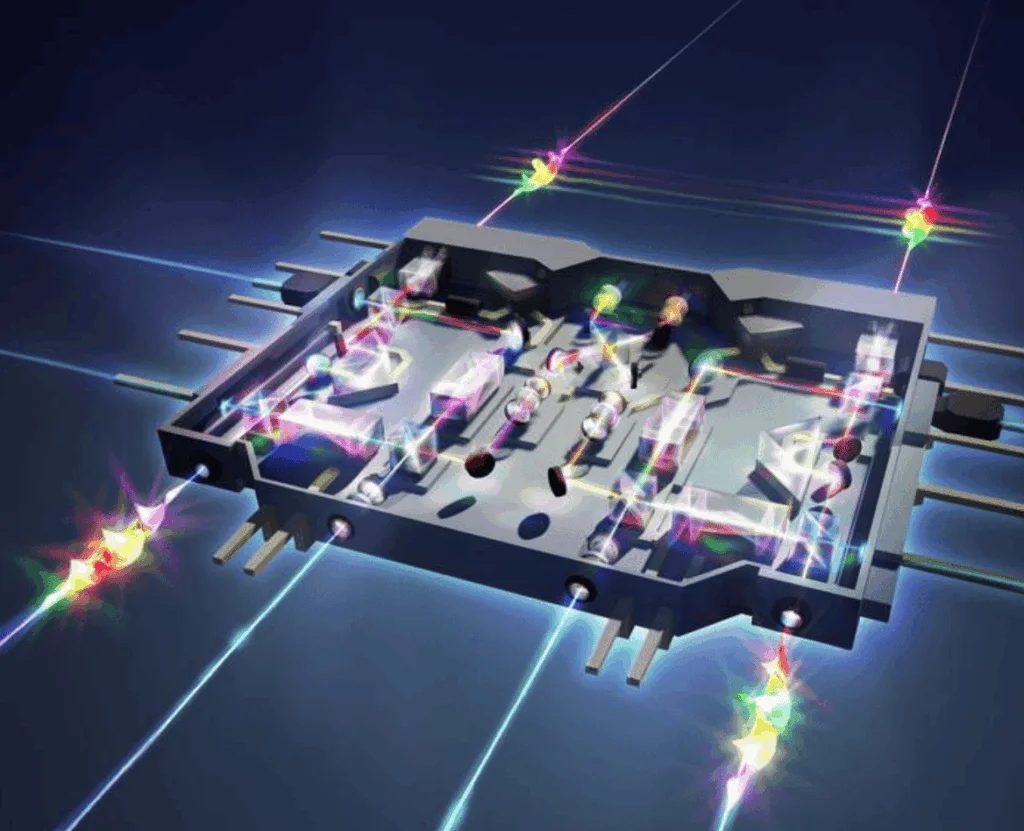

Quantum computing would make current cryptographic techniques unsafe, according to the researchers. This means that we will enter the post-quantum cryptographic era.

“Methods and algorithms will have to be changed,” they write. “Post-quantum cryptography, or quantum-resistant cryptography, is a flourishing sector of study both in academia and with firms involved in cryptography. Some firms already offer products for post-quantum cryptography, which will be big business.”

2. The Birth of Quantum AI

One of the biggest changes for economist and financial engineers will be the creation of quantum artificial intelligence or machine learning. The researchers point out that, although we have made vast improvements in our understanding of machine problem solving, our brute-force computational approach does not know offer us deep insights into the way human intuition related to problem-solving. That could change with quantum computers.

“The search space of quantum computers could be thousands of time larger than the search space considered by current computers,” they write “It would become feasible to synthesize a design from specifications and machines could become more ‘creative’ through the ability to explore an immense range of possible design solutions.”

For finance and economics, that boost in machine creativity could be a revolution.

“In the fields of finance and economics, quantum computing could lead to analyzing a large space of heterogeneous data to make financial and predictions and understanding economic phenomena,” the researchers added.

3. Solving the Unsolvable

Currently, supercomputers are used to help design products and materials, invent new drugs, create electronic circuits, model economies, organize large-scale logistics and study the climate. They’re also used to built weapons of greater and greater lethality.

But, supercomputers can only do so much. It is reasonable to assume that if quantum computers overtake classical supercomputers at these tasks their ability to produce these — positive and negative — products will exponentially increase. The economic effects would be seismic, if so.

They may even be able to produce solutions for some of the most difficult challenges.

“The study of combustion and turbulence, the study of molecules from basic physical principles (quantum-mechanical simulation), engineering nuclear fusion and even logistic problems are some of the grand Challenges of computation as defined by federal High Performance Computing and Communications (HPCC) program,” the researchers write. “Solving these problems would give a firm or even a nation an important competitive advantage. There is, of course, also the sinister possibility of creating more destructive weapons.”

Warnings and Caution

Quantum computing was always thought to be in the distant future, but these researchers write that at least the edge of the quantum era is now upon us and planning should be started now. Some cautions are also in order.

“Amid such hope, caution is necessary: financial and economic data are truly complex, and analysis will not necessarily lead to more accurate predictions given the complexity of data,” the researchers warn. “The complexity and non-stationarity of data might defy analysis. In other words, it is questionable if the use of quantum computing will reduce uncertainty.The global effect of quantum computing on economic and social life will depend on the use that will be made of this tool—and that stems from human decisions rather than being forced by knowledge itself.”