At first, experts speculated IF quantum technology would be realizable, let alone impact the market.

Recently, most people migrated from IF quantum technology would impact the market to WHEN it would happen.

Now, people are wondering WHERE that impact will be felt.

According to the Wall Street Journal, a panel of experts at a quantum-computing event hosted by IBM suggested that financial services will be the first to benefit.

That’s because a quantum algorithm could be deployed to help create a new financial model that would have immediate impact, said Jeremy Glick, head of research-and-development engineering at Goldman Sachs. He told the group that, for example, a quantum algorithm could be developed to manage a new financial model in days or weeks. He compared that to the impact that a quantum computer might have in the pharmaceutical industry, which, even if a quantum computer is much faster at finding new drugs or materials, it would still take years for those products to reach the market.

“In the universe of industries where there is a potential quantum advantage, you could argue that finance has got the shortest path to impact,” Glick said.

The R&D head also said fintech pioneers who are ready to adopt quantum computers face two obstacles. First, access to commercial-grade quantum computers is limited.

Second, companies aren’t sure how to use quantum computers just yet.

“I think the big win is finding something entirely new, and we haven’t found that yet,” Glick said.

At this point, Glick advised event-goers to become “quantum conversant.” Professionals need to learn about how quantum computing works and how it can be applied to financial industries, as well as other sectors, he said. College students should study quantum computing as a minor and then work with banks and regulators on applications, Glick added.

JPMorgan Chase & Co. is already working on those quantum-conversant skills, said Nikitas Stamatopoulos, JPMorgan Chase & Co. vice president of quantitative research. He said the company is working toward cultivate quantum-computing skills for some employees.

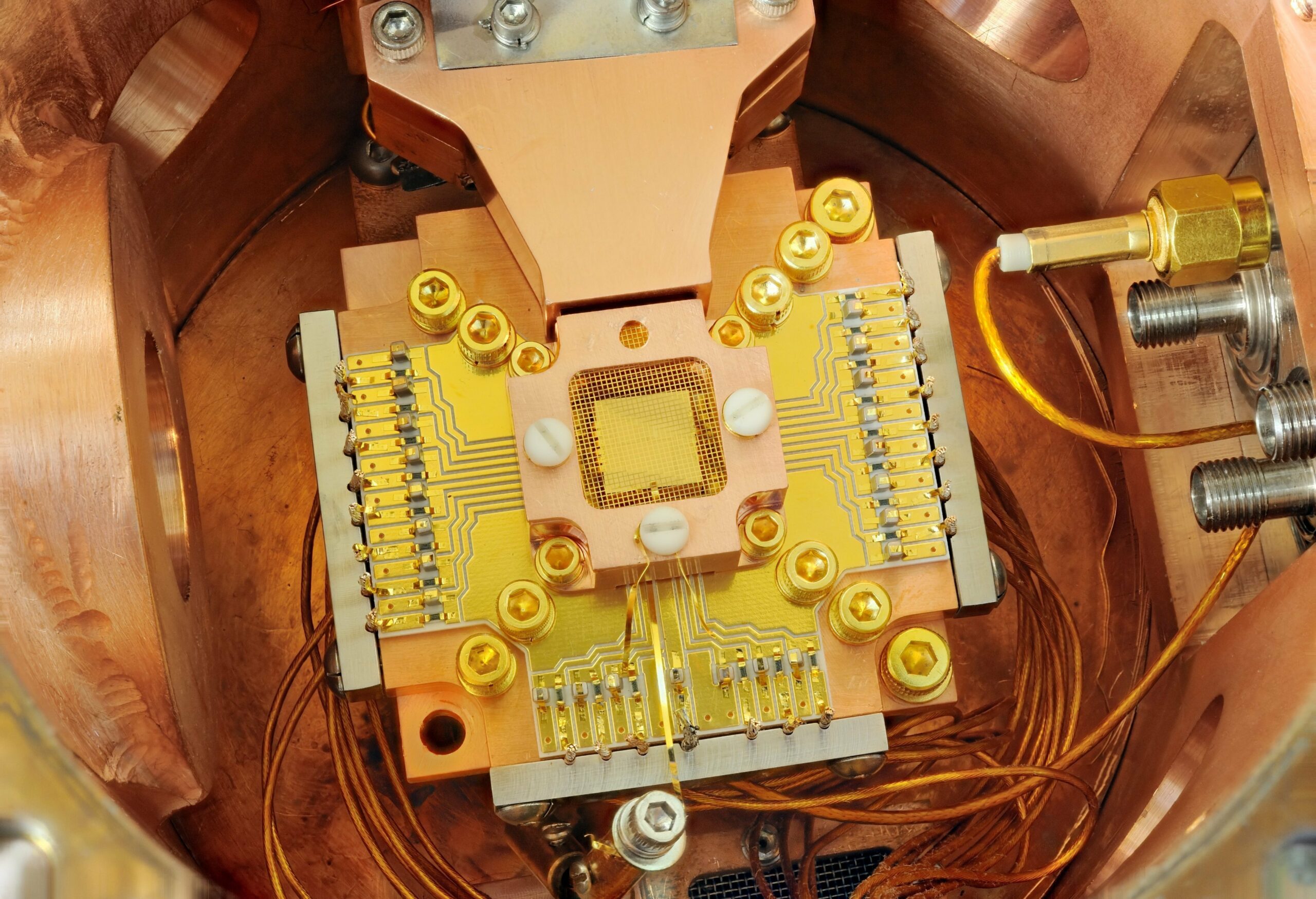

Since late 2017, the company has been collaborating with researchers at IBM to experiment with quantum computing, according to the WSJ. A working group from the bank has been running tests through the cloud on IBM’s early-stage quantum-computing machine, which is suitable for small-scale experiments.

Initial results are positive, according to Stamatopoulos. The team has found that quantum computing could be used to speed up computationally intensive processes, such as option-pricing and risk-assessment calculations. But, all of this work is preliminary.

“If we had one today, what would we do? The answer today is not very clear,” Stamatopoulos said.