A Round Peg, Square Hole

Ask yourself this question:

Do you wanna be rich?

Chances are, you do — no, sorry, the fact is you do. I don’t care who you are: an Orange-garbed Buddhist monk or a Marxist rebel hiding out in some Central American jungle, there’s a Warren Buffet waiting to get out.

Tell me otherwise and I’ll say you’re a hypocrite, a degenerate liar who doesn’t know his hat from his asshole.

For the last six thousand years, there have been a few ways to accumulate wealth: by bartering, exchanging goods — cattle, gold, even people. The medium isn’t important here, though.

Then money came into existence, and we coveted that.

Still do, I suppose.

But a decade ago, a smart one(s), a being(s) that the late Steve Jobs would call ‘a round peg in a square hole’, of unknown provenance, brought out a whitepaper that was to change the world of finance forever.

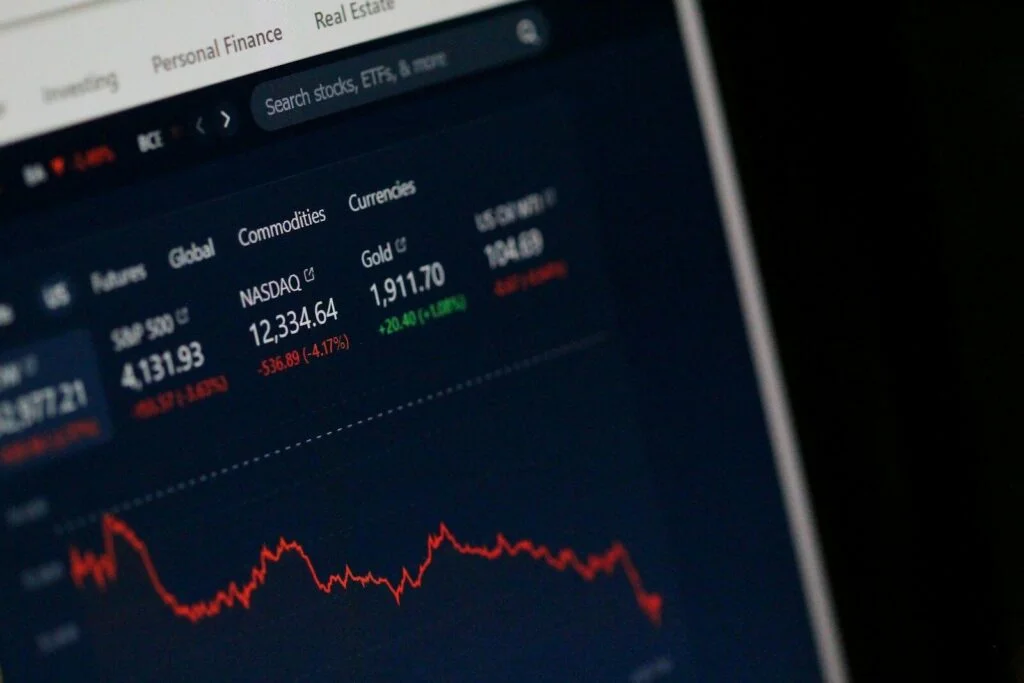

Bitcoin, a tradable digital asset, was born. And that has spurned a plethora of other cryptocurrencies, otherwise known as altcoins.

Competition for fiat currency.

Buffet’s bread and butter. (this is no criticism of Buffet, I personally like him.)

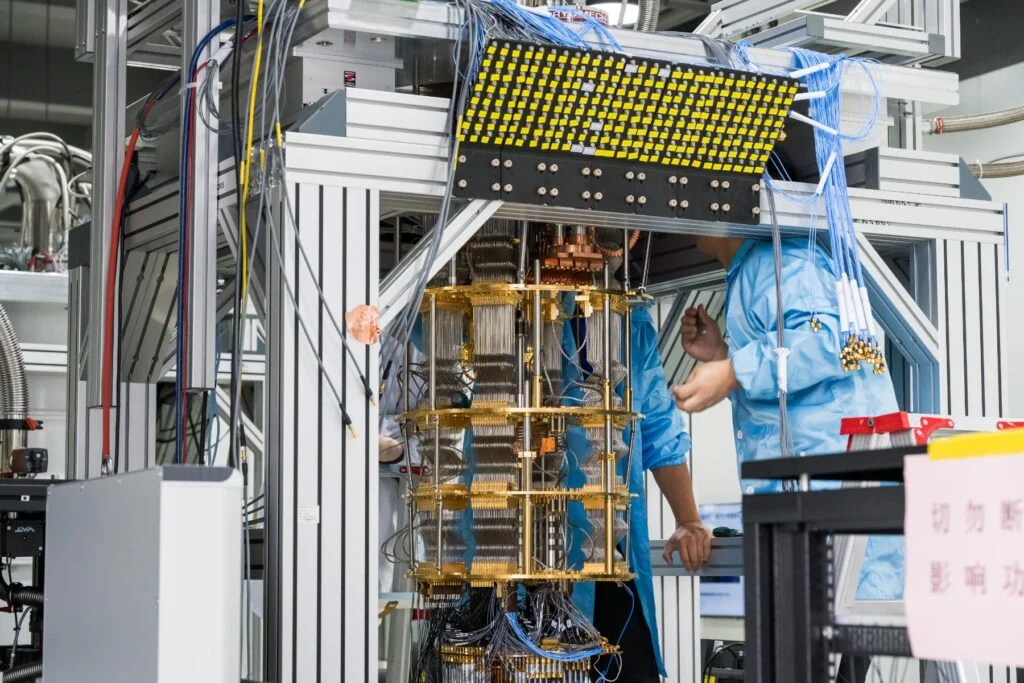

The 54-Qubit Sword of Damocles

For a few years now, crypto’s underlying architecture, blockchain — which I won’t go into here — and the digital currency itself, has come under scrutiny for how really secure it is, especially in the face of that potentially Sword-of-Damocles hard-tech invention that can, without doubt, sink the crypto/blockchain ship faster than a fat rock, quantum computing (QC).

A few weeks ago, Google announced it had attained ‘Quantum Supremacy’, the cheeky claim that quantum computers are able to do computations far better and quicker than even the world’s most powerful classical computers, with its new 54-qubit Sycamore quantum processor (though the latest news is that IBM refutes the declaration).

Whether they have or not is anybody’s guess, but what it does go to show is the big players in the QC space are serious about the industry and what it can potentially do.

This has got many experts within the QC, crypto and blockchain industries second-guessing each other.

None more so than those with a vested interest in Bitcoin and other altcoins, particularly those crypto exchanges like Binance, Coinbase, BitPanda, etc. Advocates of the digital currency, such as British-Greek blockchain expert Andreas Antonopoulos, were sharp to play the threat down.

Andreas Antonopoulos. Source: btcnn.com

Andreas Antonopoulos. Source: btcnn.com

But of course they would. They’ve got a vested interest in the space, haven’t they?

Defense

At a Q&A session recently, Antonopoulos defended Bitcoin against the menace that quantum computers could pose for its security in the future.

He responded by saying:

‘What is the effect on mining and the cryptocurrency world in general? Zip, bupkis, nada, nothing really happens.’

Swallowing foreign dictionaries aside, there is a sense using some Yiddish and Spanish words doesn’t hide the sour grapes of his views.

This is not to say Bitcoin can’t have a place in the world: it is a wonderful piece of technology that will most certainly change the way financial transactions are conducted in the coming years, but there are some people who really have a problem with those showing an agenda.

And Antonopoulos has such an agenda.

An intelligent man like that doesn’t need to have one. It is obvious, either by next year or in a century from now, that quantum computers will break the current RSA algorithms used by classical computers as well as the digital signature ECDSA algorithms with elliptic curve underpinning Bitcoin.

It’s only a matter of time.

So, please, Mr Antonopoulos, you’ve done well out of crypto, so let the argument go, because you’ve got egg on your face.