Insider Brief

- D-Wave released its financial results, showing, among other metrics, a 41% revenue increase in Q3 to Q4 sequential revenue growth.

- The number of commercial customers also increased by 18% to 67 during fiscal 2022, pointing toward more quantum interest in adoption.

- The company also reported it secured a $50 million loan, which should give the company more breathing space.

Critical Quote: “Sixty-seven commercial customers used D-Wave solutions in 2022, and we now count more than two dozen of the Forbes Global 2000 as customers, as an increasing number of companies turn to quantum computing to solve complex business problems ranging from customer loyalty to supply chain logistics to e-commerce optimization.” Alan Baratz, CEO of D-Wave

PRESS RELEASE —D-Wave Quantum Inc., (NYSE: QBTS) a leader in quantum computing systems, software, and services, and the only commercial provider building both annealing and gate-model quantum computers, today announced financial results for its fourth quarter and fiscal year ended December 31, 2022.

“We believe our fourth quarter and 2022 year-end results reflect a clear signal: companies are rapidly embracing today’s quantum technology solutions to drive competitive advantage, now. In this complex economic environment, business leaders are actively looking for ways to improve operational efficiencies, reduce costs, fuel innovation, and increase revenue. We believe that near-term quantum and quantum-hybrid applications are critical for navigating this complexity by helping solve businesses’ most difficult computational problems. Our revenue metrics reflect increasing quantum adoption, which accelerated growth of our business and drove a 41% increase in Q3 to Q4 sequential revenue growth,” said Dr. Alan Baratz, CEO of D-Wave. “Sixty-seven commercial customers used D-Wave solutions in 2022, and we now count more than two dozen of the Forbes Global 2000 as customers, as an increasing number of companies turn to quantum computing to solve complex business problems ranging from customer loyalty to supply chain logistics to e-commerce optimization. Beyond our continued commercial traction, we’re driving ongoing innovation and advancement of our product portfolio, most recently introducing new offerings that help customers harness quantum to accelerate artificial intelligence and machine learning efforts. We’re seeing accelerating momentum across all facets of our business. Finally, we are pleased to announce the closing of a $50 million four-year term loan.”

Recent Commercial / Business Highlights

- Hosted our 7th annual user conference, Qubits 2023, with the commercialization of quantum on full display as more than a dozen companies, including Mastercard, Deloitte, and Davidson Technologies, showcased quantum and quantum-hybrid applications and demos built on D-Wave solutions

- Signed a number of new and expanded customer engagements with Forbes Global 2000 companies as well as industry leaders such as ArcelorMittal, BASF, Unisys, Mastercard, Deloitte, Davidson Technologies, uptownBasel, Siemens Healthineers, and New Mexico Consortium

- Increased average QCaaS deal size by 78% on a year-over-year basis and entered 2023 with $5.8 million in a combination of firm backlog and prior-year contracts expected to renew in 2023

- Continued expansion of our commercial customer base with 67 revenue-generating commercial customers in 2022, a 18% year-over-year increase over 2021

- Worked with customers on a variety of new and expanded quantum hybrid applications including industrial manufacturing, fraud detection, missile defense optimization, employee scheduling, and medical imaging, and we are seeing an acceleration of customers moving applications into production

- Announced a series of initiatives designed to enhance production- and commercial-readiness, including SOC 2 Type 2 compliance, which is designed to ensure the safety and privacy of customer data

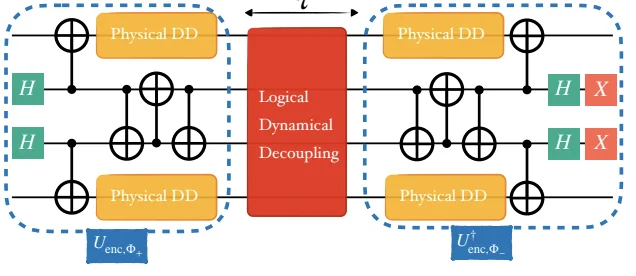

Recent Technical Highlights

- Announced plans to build and deliver feature selection solutions to help customers expedite artificial intelligence/machine learning workflows, including the launch of a new hybrid solver plug-in

- Launched availability of the Leap™ quantum cloud service in our 39th country, providing businesses, developers, and researchers in Israel access to D-Wave’s Advantage™ quantum computer, hybrid quantum/classical solvers, and integrated developer environment (IDE) to drive the development of business-critical, in-production hybrid applications

- Experienced continued growth of our quantum cloud service, as more than 50 million problems have been run on our Advantage annealing quantum computer directly and through hybrid solvers since September 2020, and we’ve seen a 76% YoY increase in problems submitted from 2021 to 2022

- Continued progress with the next-generation Advantage2 annealing quantum system, which is expected to feature 7000+ qubits, 20-way connectivity and higher coherence to solve even larger and more complex problems. Building on the successful integration of a new high coherence fabrication process which has demonstrated a 4x reduction in noise, we have completed an initial calibration of a processor fabricated with this new process

- Progressed our gate model program by benchmarking one and two qubit fluxonium qubit circuits, validating a new scalable readout method for our gate model design, and introducing a new gate model simulator in our Ocean suite of software tools, which we believe will help developers to advance their quantum designs

- Extended our scientific efforts through the publication of research in Nature Physics that demonstrated large-scale coherence in quantum annealing computers, an important step toward proving quantum advantage

Fourth Quarter Fiscal 2022 Financial Highlights

- Revenue: On a sequential quarter-to-quarter basis, fiscal 2022 fourth quarter revenue of $2.4 million increased by $700,000, or 41%, from the immediately preceding fiscal 2022 third quarter revenue of $1.7 million that increased by $326,000, or 24%, from the immediately preceding fiscal 2022 second quarter revenue of $1.4 million

- The $2.4 million in fiscal 2022 fourth quarter revenue was essentially flat when compared to the year earlier fiscal 2021 fourth quarter revenue of $2.4 million that included $350,000 of non-recurring revenue. Adjusting for the fiscal 2021 fourth quarter non-recurring revenue, the year over year growth was 15.3%

- The percentage of fiscal 2022 fourth quarter revenue derived from commercial customers was 72.4%, an increase of 32.1% from 40.3% in the year earlier fiscal 2021 fourth quarter with the fiscal 2022 fourth quarter representing the second consecutive quarter of sequential quarter to quarter growth in commercial revenue as a percent of total revenue with the fiscal 2022 second and third quarter commercial revenue percentages at 46.5% and 62.2% respectively

- GAAP Gross Profit: GAAP gross profit for the fiscal 2022 fourth quarter was $1.3 million, a decrease of $289,000, or 28%, from the immediately preceding fiscal 2022 third quarter GAAP gross profit of $1.0 million, that increased by $256,000, or 33%, from the immediately preceding fiscal 2022 second quarter GAAP gross profit of $785,000. The $1.3 million in 2022 fourth quarter GAAP gross profit decreased by $219,000, or 14% from in the fiscal 2021 fourth quarter GAAP gross profit of $1.5 million

- Non-GAAP Gross Profit1: Non-GAAP gross profit for the fiscal 2022 fourth quarter was $1.6 million, an increase of $543,000, or 50%, from the immediately preceding fiscal 2022 third quarter non-GAAP gross profit of $1.1 million, that increased by $266,000, or 32%, from the immediately preceding fiscal 2022 second quarter non-GAAP gross profit of $820,000. The fiscal 2022 fourth quarter non-GAAP gross profit of $1.6 million increased by $80,000, or 5.2% when compared to the year earlier fiscal 2021 fourth quarter non-GAAP gross profit of $1.5 million. The difference between GAAP and non-GAAP gross profit is limited to non-cash stock-based compensation expense that is excluded from the non-GAAP gross profit

- GAAP Gross Margin: GAAP gross margin for the fiscal 2022 fourth quarter was 55.5%, a decrease of 5.9% from the immediately preceding fiscal 2022 third quarter GAAP gross margin of 61.4%, that increased by 4.1% from the immediately preceding fiscal 2022 second quarter GAAP gross margin of 57.3%. The fiscal 2022 fourth quarter GAAP gross margin of 55.5% compares with a 63.8% GAAP gross margin in the year earlier fiscal 2021 fourth quarter

- Non-GAAP Gross Margin2: Non-GAAP gross margin for the fiscal 2022 fourth quarter was 68.1%, an increase of 4.0% from the immediately preceding fiscal 2022 third quarter non-GAAP gross margin of 64.1%, that increased by 4.3% from the immediately preceding fiscal 2022 second quarter non-GAAP gross margin of 59.8%. The fiscal 2022 fourth quarter non-GAAP gross margin of 68.1% increased by 4.3% from the year earlier fiscal 2021 fourth quarter non-GAAP gross margin of 63.8%. The difference between GAAP and non-GAAP gross margin is limited to non-cash stock-based compensation expense that is excluded from the non-GAAP gross margin

- GAAP Operating Expenses: GAAP operating expenses for the fiscal 2022 fourth quarter were $22.4 million compared with $12.4 million in the fiscal 2021 fourth quarter

- Non-GAAP Adjusted Operating Expenses3: Non-GAAP operating expenses for the fiscal 2022 fourth quarter totaled $15.9 million compared with $10.9 million in the fiscal 2021 fourth quarter

- Net Loss: Net loss for the fiscal 2022 fourth quarter was $12.5 million, or $0.10 per share, compared with $13.8 million, or $0.11 per share, in the fiscal 2021 fourth quarter

- Adjusted EBITDA4: Adjusted EBITDA for the fiscal 2022 fourth quarter was negative $14.5 million, compared with a negative $9.3 million in the fiscal 2021 fourth quarter

We are providing non-GAAP gross profit, non-GAAP gross margin, adjusted operating expenses and Adjusted EBITDA as we believe these metrics improve investors’ ability to evaluate our underlying performance. Non-GAAP measures do not have any standardized meaning under GAAP, and therefore may not be comparable to similar measures employed by other companies.

- “Non-GAAP gross profit” is a non-GAAP financial measure. For a description of non-GAAP gross profit and a reconciliation to gross profit, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

- “Non-GAAP gross margin” is a non-GAAP financial measure. For a description of non-GAAP gross margin and a reconciliation to gross margin, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

- Adjusted operating expenses is a non-GAAP financial measure. For a description of adjusted operating expenses and a reconciliation to operating expenses, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

- Adjusted EBITDA is a non-GAAP financial measure. For a description of Adjusted EBITDA and a reconciliation to net loss, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release

Fiscal Year 2022 Financial Highlights

- Revenue: Revenue for fiscal 2022, was $7.2 million, an increase of $894,000, or 14.2%, from $6.3 million in fiscal 2021

- The percentage of fiscal 2022 revenue derived from commercial customers was 60.3%, an increase of 5.3% from 55% in fiscal 2021

- Customers: For fiscal 2022, D-Wave had 67 commercial customers, an increase of 10, or 18%, from 57 commercial customers in fiscal 2021, with the 67 commercial customers including over two dozen Forbes Global 2000 companies. For fiscal 2022, D-Wave had a total of 112 customers, an increase of 17, or 18%, from a total of 95 customers in fiscal 2021. D-Wave defines a customer as one in which revenue is recognized during the period

- Bookings: During fiscal 2022, the average value of a QCaaS booking was 78% higher than the average value of a QCaaS booking in fiscal 2021

- GAAP Gross Profit: GAAP Gross profit for fiscal 2022 was $4.3 million compared with $4.5 million in fiscal 2021

- Non-GAAP Gross Profit1: Non-GAAP gross profit for fiscal 2022 was $4.6 million compared with $4.5 million in fiscal 2021

- GAAP Gross Margin: GAAP gross margin for fiscal 2022 was 59.3% compared with fiscal 2021 GAAP gross margin of 72.1%

- Non-GAAP Gross Margin2: Non-GAAP gross margin for fiscal 2022 was 64.5% compared with fiscal 2021 non-GAAP gross margin of 72.1%

- GAAP Operating Expenses: GAAP operating expenses for fiscal 2022 were $63.7 million compared with $43.5 million in fiscal 2021 with the primary difference between GAAP and non-GAAP operating expenses being non-cash stock-based compensation expense and non-cash depreciation expenses that are excluded from the non-GAAP operating expenses

- Non-GAAP Adjusted Operating Expenses3: Non-GAAP operating expenses for fiscal 2022 were $52.4 million compared with $40.3 million in fiscal 2021

- Net Loss: Net loss for fiscal 2022 was negative $51.5 million, or negative $0.43 per share, compared with negative $31.5 million, or negative $0.25 per share, in fiscal 2021

- Adjusted EBITDA4: Adjusted EBITDA for fiscal 2022 was negative $48.0 million compared to a negative $35.7 million in fiscal 2021

Balance Sheet and Liquidity

D-Wave ended the year with $7.1 million in cash and subsequently raised $15.7M under the Lincoln Park Equity Line of Credit during the months of January and February. As previously disclosed, D-Wave entered into a common stock purchase agreement (Equity Line of Credit or “ELOC”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”) on June 16, 2022, wherein the Company has the right, but not the obligation, to issue and sell up to $150 million of shares of its common stock to Lincoln Park, subject to certain limitations and satisfaction of certain conditions, over a 3-year period. Since the agreement was entered into, D-Wave has raised approximately $20 million under the ELOC. On February 13, 2023, D-Wave filed a related Form S-1 Registration Statement.

On April 13, 2023, D-Wave entered into a $50 million four-year term loan agreement with PSPIB Unitas Investments II Inc., an affiliate of PSP Investments. The initial advance under the term loan is $15 million with second and third advances of $15 million and $20 million respectively, subject to certain terms and conditions.

Fiscal Year 2023 Outlook

We provide the financial guidance below based on current market conditions and expectations. Our guidance is subject to various important cautionary factors described below. Based on information available as of April 13, 2023, guidance for the full year 2023 is as follows:

- Revenue

- Revenue is expected to be in the range of $12 million to $13 million representing year-over-year growth of 67% to 80%, a growth rate range that the Company expects to maintain over the next several years

- FY 2023 revenue guidance is supported by $4.6 million in contracted backlog as of December 31, 2022 and $1.2 million in contracts entered into in prior periods that are expected to renew throughout 2023 that represents 45% to 48% of the 2023 expected revenue.

- Adjusted EBITDA

- Adjusted EBITDA is expected to be less than negative $62 million4

- We are not able to reconcile guidance for Adjusted EBITDA to its most directly comparable GAAP measure, net loss, and cannot provide an estimated range of net loss for such period without unreasonable efforts because certain items that impact net loss, including foreign exchange and stock-based compensation, are not within our control or cannot be reasonably predicted.

Fourth Quarter 2022 Conference Call

In conjunction with this announcement, D-Wave will host a conference call on Friday, April 14, 2023, at 8:00 a.m. (Eastern Time), to discuss such financial results and its business outlook. The live dial-in number is 1-877-407-3982 (domestic) or 201-493-6780 (international), conference ID code 13738032. A live webcast and subsequent replay of the call will also be available on the “Investors” page of the Company’s website at: http://ir.dwavesys.com/.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.