Financial experts may be able to take a hybrid approach to portfolio optimization even with current-era quantum computers, according to a team of JP Morgan Chase Bank-led researchers.

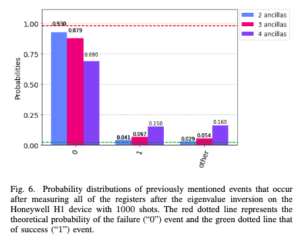

In a study, which was published on the ArXiv preprint server, the researchers demonstrated the effectiveness of their NISQ-HHL approach, calling it the first hybrid formulation of HHL suitable for the end-to-end execution of small-scale portfolio-optimization problems on NISQ devices.

The HHL algorithm was introduced by Harrow, Hassidim and Lloyd, but is noted for being cumbersome to deploy on Noisy Intermediate-Scale Quantum — or NISQ — devices. Current quantum computers are vulnerable to environmental noise, such as heat, that increases the number of errors.

According to the paper, the research team’s enhanced formulation of the classical/quantum hybrid HHL algorithm integrates mid-circuit measurement, Quantum Conditional Logic and qubit reset and reuse into the separate Quantum Phase Estimation routine used for eigenvalue estimation.

They added that this approach offers two advantages: it reduces the number of ancillary qubits to just one and it reduces the requirement for qubit connectivity, SWAP gates or qubit transport.

Initially, the researchers used the approach on two assets from the S&P 500. To test whether the scheme could scale to larger portfolio problems, the team tested it on portfolio-optimization problems consisting of 6 and 14 assets from the S&P 500.

Initially, the researchers used the approach on two assets from the S&P 500. To test whether the scheme could scale to larger portfolio problems, the team tested it on portfolio-optimization problems consisting of 6 and 14 assets from the S&P 500.

The team demonstrated that they obtained the “optimal allocation vector represented as a quantum state for a portfolio-optimization problem with two S&P 500 assets” and that the approach could scale to portfolios of any size.

Many financial firms are looking toward quantum to give them advantages in computations that are particularly difficult in their industry. Portfolio optimization, a computationally complex problem, is one of them.

The researchers write: “Portfolio optimization is an essential use case in finance, but its computational complexity forces financial institutions to resort to approximated solutions, which are still time consuming. Thus, the scientific community is looking at how quantum computing can be used for efficient and accurate portfolio optimization.”

The team said the approach isn’t limited to just financial computations.

“Although this paper focuses on portfolio optimization, the techniques it proposes to make HHL more scalable are generally applicable to any problem that can be solved via HHL

in the NISQ era,” the researchers write.

JP Morgan Chase Bank’s research team included Romina Yalovetzky, Pierre Minssen, Dylan Herman and Marco Pistoia, all of the Future Lab for Applied Research and Engineering. They performed their experiments using the Honeywell System Model H1, a trapped-ion quantum computer.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.