You need a map before you reach a destination.

Now, a team of IBM and Goldman Sachs researchers have started to draw up a map to use quantum computers to better manage the oft-estimated quadrillion-dollar derivatives market by first estimating how powerful those quantum computers must be to outperform classical computers in determining derivative pricing — a critical, computationally intense financial calculation. They added that, based on their estimates, current quantum computers aren’t quite up to speed to outmatch classical computers, but they offered a path to get there.

Quantum computers would need 7,500 logical qubits and a T-depth of 46 million to calculate derivatives better than classical computers.

In a study, which the team added to the preprint server arXiv, the researchers report that to calculate derivatives better than classical computers, quantum computers would need 7,500 logical qubits and a T-depth of 46 million, which refers to the number of gates, or operations a qubit can perform before decoherence. They also estimate the threshold of quantum advantage would require a logical clock speed of about 10 Mhz or faster, assuming a target of 1 second for pricing certain types of derivatives.

It’s the first detailed estimate of the quantum computing resources needed to achieve quantum advantage for derivative pricing. The scientists describe quantum advantage as a task that quantum computers can do significantly better that their classical counterparts.

According to the researchers, determining quantum advantage is a necessary first step in integrating quantum computers with finance.

In an IBM blog post, two researchers involved in the project, Stefan Woerner and William Zeng, write that calculating derivatives is both important — and challenging.

“The financial services industry is full of potential applications for quantum computing, including optimization, simulation and machine learning. But it’s not that easy to determine which applications are most likely to benefit from quantum advantage, and exactly how powerful quantum computers must be to run those applications significantly better than classical systems can,” they write.

The resource requirements are out of reach for current quantum computers, according to the researchers, but the team aims to provide a roadmap to further improve algorithms, circuit optimization, error correction and planned hardware architectures to create a quantum computer that can handle the task.

Why Quantum Computers Are Needed

According to the researchers, financial analysts currently calculate derivatives by using Monte Carlo simulations on classical computers. Analysts randomly simulate how asset price change over time. This takes large number of these simulations to get reasonable results.

To calculate derivative prices using classical computers, analysts would need to increase the number of samples in a Monte Carlo simulation by a factor of 100 to improve an estimate’s precision by an order of magnitude. This greatly slows down the process, the researchers said. On a quantum computer, analysts would increase samples by a factor of 10 to improve by the same amount, which is called a quadratic speedup.

“Theoretically, the same simulations could be performed on a quantum computer to reach an answer much quicker,” the researchers report. “It’s been unclear, however, how much faster quantum computers will be, and how robust a quantum computer needs to be to outperform a classical computer for this particular application.”

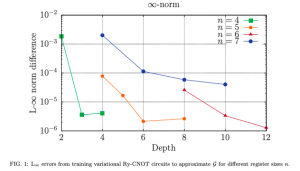

The team’s approach – called the re-parameterization method – offers a promising new quantum path toward derivative pricing, the researchers report. The method combines pre-trained quantum algorithms with approaches from fault-tolerant quantum computing to dramatically cut the estimated resource requirements for pricing financial derivatives using quantum computers.

The researchers offer this advice for others investigating quantum’s role in derivatives estimation: “In transparently calculating our estimates, we enable our ongoing research – as well as other research teams – to examine every subroutine in this algorithm and in this estimate and determine how much each particular step matters for the overall runtime. We can say, for example, to an algorithm or error-correction researcher, these are the things you should be trying to improve that will have the most impact on reducing the resources necessary for quantum advantage in derivative pricing.”

They add: “This is the kind of research that’s most valuable to the industries that will eventually adopt quantum computing – go as deep and technical as you can while also connecting the work back to the business use cases that provide value to your clients.”

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.