Flexing The Muscles

More good news out of the quantum technologies startup space. Aliro Technologies, which started life out at Harvard innovation labs, has raised $2.7 million from a successful seed round.

The announcement, one of many in recent times, just goes to show how well developed the industry is becoming, as well as proving it is possible for up-and-coming startups to flex their muscles in the industry and make a difference.

‘Aliro’s goal is to enable software developers using its hardware-independent, cloud-ready platform to take advantage of the power of quantum computing.’

— Professor Prineha Narang, CTO Aliro Technologies

Startup’s Focus

The company’s business is focused on hardware-agnostic tools which empower developers to write and formulate software which can run on quantum computers with ease. As well as developing software tools to help developers, the startup also has software to assist the developers in utilizing quantum apps while helping them to choose the most suitable one to achieve a certain task on a quantum computer. This approach, it is hoped, will make it easier for those wishing to become involved in the industry to do so.

‘Aliro is the melding of computer science and quantum physics.’

— Jim Ricotta, CEO, Aliro Technologies

Although quantum computing is still in its embryonic stage of development as far as scalable, working computers that can assist us in our everyday lives is still some years away, investment in the space is rising year-on-year.

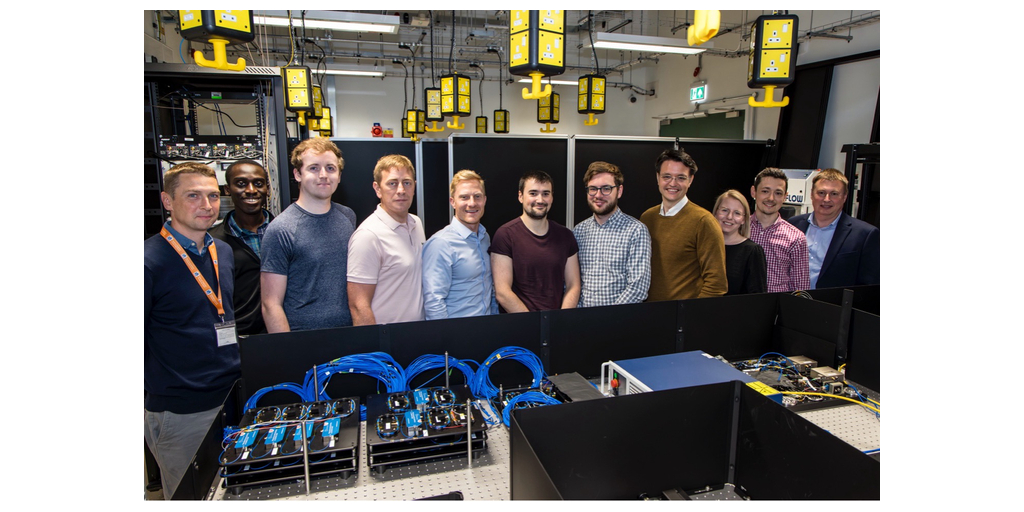

Cofounded this spring by Harvard assistant professor of Computational Materials Science and CTO, Prineha Narang, and headed by CEO Jim Ricotta, the startup aims for its software to be compatible with the hardware of the big players such as IBM and others. Coincidentally, Aliro Technologies is a partner of the New York-based tech giant, which can only bode well for the future.

And in Narang the startup has a woman with an impressive CV: Picked for MIT’s Tech Review ‘35 under 35’, not to mention also being included in Forbes’ list for ‘30 Under 30 in the Science Pick’, with such an esteemed CTO leading from the front, it is no wonder the investment companies have come sniffing around.

Investment Opportunity

With Samsung Next’s Q Fund, Crosslink Ventures and Flybridge Capital Partners showing obvious foresight to the potential of Aliro Technologies, they see the QC industry only getting bigger, and with that, the chance to earn exponentially on their investment. There are already estimates that by the beginning of the 2030s, the QC industry will be worth an estimated $50 billion according to Deloitte TMT Predictions for 2019. If this is the case, the investment is surely justified.

So what does the startup intend to do with the money?

‘I have been working with the Aliro team for the past year and could not be more excited about the opportunity to help them build a foundational company in quantum computing software. Their innovative approach and unique combination of leading quantum researchers and a world-class, proven executive team, make Aliro a formidable player in this dynamic new sector.’

— David Aronoff, General Partner at Flybridge

According to Ricotta, with the cash injection the company intends to hire more people, especially on the technical side of things, where they want to attract two types of employees: first of all experts in the quantum computing field such as quantum physicists and engineers. Secondly, programmers with a traditional background in software applications and engineering.

With them, and with the right guidance from the new investment team, things are looking up for Aliro Technologies.